Blog

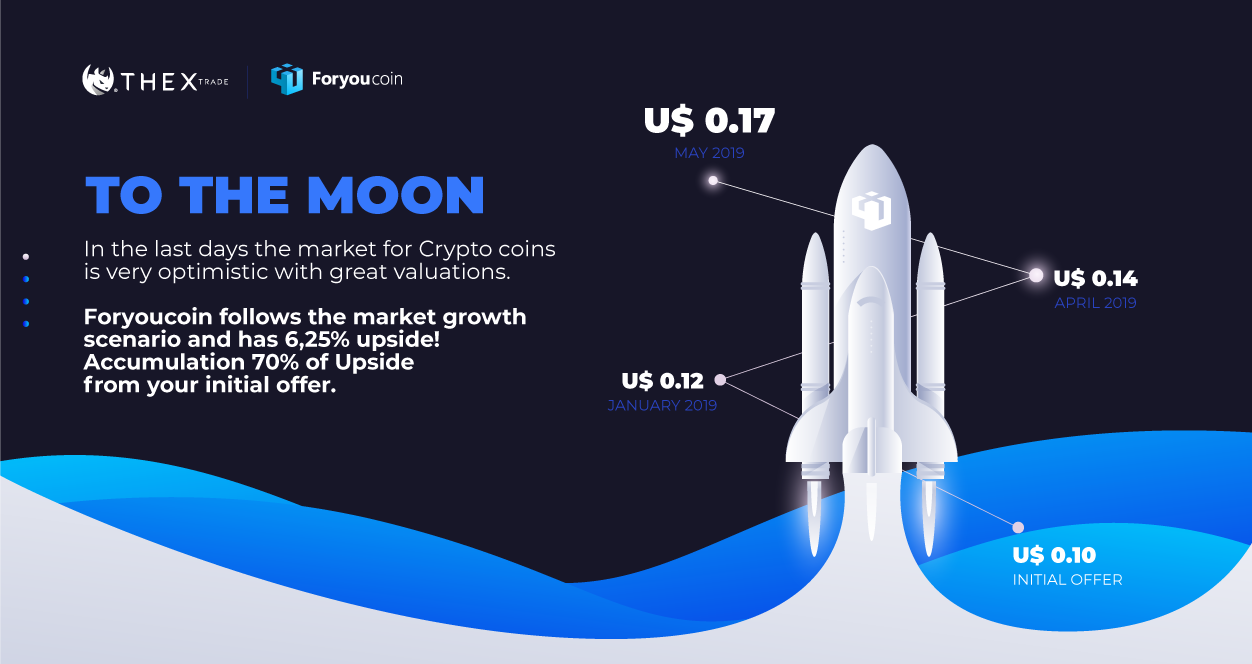

Great Valuations

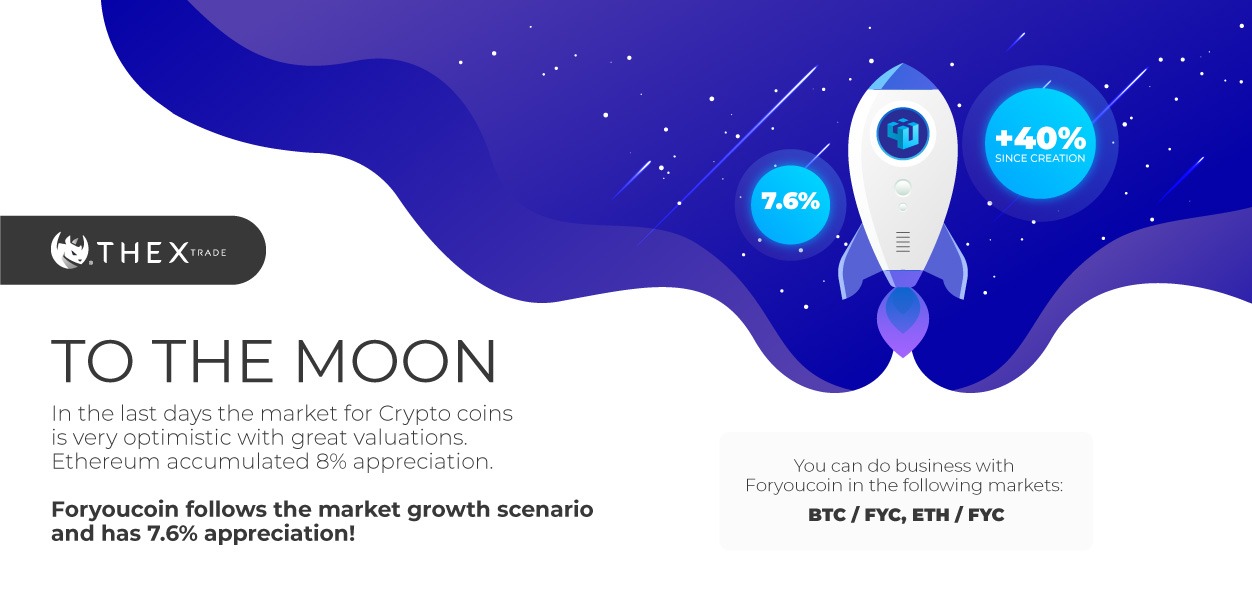

You can do business with Foryoucoin in the following markets: BTC / FYC, ETH / FYC.

Great valuations

You can do business with Foryoucoin in the following markets: BTC / FYC, ETH / FYC.

Market orders are available

We inform you a new mode of action for buying and selling crypto currencies is available at Thex Trade.

We started working with an exchange method known as Market. Previously the only available exchange was the Limit method. However, to ensure a greater simplification in the execution of orders and values the user can now do it using only the platform in the basic version.

We appreciate your understanding and cooperation.

What is Bitcoin?

To cut through some of the confusion surrounding bitcoin, we need to separate it into two components. On the one hand, you have bitcoin-the-token, a snippet of code that represents ownership of a digital concept – sort of like a virtual IOU. On the other hand, you have bitcoin-the-protocol, a distributed network that maintains a ledger of balances of bitcoin-the-token. Both are referred to as "bitcoin."

The system enables payments to be sent between users without passing through a central authority, such as a bank or payment gateway. It is created and held electronically. Bitcoins aren't printed, like dollars or euros – they're produced by computers all around the world, using free software.

It was the first example of what we today call cryptocurrencies, a growing asset class that shares some characteristics of traditional currencies, with verification based on cryptography.

Network, Globe

Who created it?

A pseudonymous software developer going by the name of Satoshi Nakamoto proposed bitcoin in 2008, as an electronic payment system based on mathematical proof. The idea was to produce a means of exchange, independent of any central authority, that could be transferred electronically in a secure, verifiable and immutable way.

To this day, no-one knows who Satoshi Nakamoto really is.

In what ways is it different from traditional currencies?

Bitcoin can be used to pay for things electronically, if both parties are willing. In that sense, it's like conventional dollars, euros, or yen, which are also traded digitally.

But it differs from fiat digital currencies in several important ways:

1 – Decentralization

Bitcoin's most important characteristic is that it is decentralized. No single institution controls the bitcoin network. It is maintained by a group of volunteer coders, and run by an open network of dedicated computers spread around the world. This attracts individuals and groups that are uncomfortable with the control that banks or government institutions have over their money.

Bitcoin solves the "double spending problem" of electronic currencies (in which digital assets can easily be copied and re-used) through an ingenious combination of cryptography and economic incentives. In electronic fiat currencies, this function is fulfilled by banks, which gives them control over the traditional system. With bitcoin, the integrity of the transactions is maintained by a distributed and open network, owned by no-one.

2 - Limited supply

Fiat currencies (dollars, euros, yen, etc.) have an unlimited supply – central banks can issue as many as they want, and can attempt to manipulate a currency's value relative to others. Holders of the currency (and especially citizens with little alternative) bear the cost.

With bitcoin, on the other hand, the supply is tightly controlled by the underlying algorithm. A small number of new bitcoins trickle out every hour, and will continue to do so at a diminishing rate until a maximum of 21 million has been reached. This makes bitcoin more attractive as an asset – in theory, if demand grows and the supply remains the same, the value will increase.

3 - Pseudonymity

While senders of traditional electronic payments are usually identified (for verification purposes, and to comply with anti-money laundering and other legislation), users of bitcoin in theory operate in semi-anonymity. Since there is no central "validator," users do not need to identify themselves when sending bitcoin to another user. When a transaction request is submitted, the protocol checks all previous transactions to confirm that the sender has the necessary bitcoin as well as the authority to send them. The system does not need to know his or her identity.

In practice, each user is identified by the address of his or her wallet. Transactions can, with some effort, be tracked this way. Also, law enforcement has developed methods to identify users if necessary.

Furthermore, most exchanges are required by law to perform identity checks on their customers before they are allowed to buy or sell bitcoin, facilitating another way that bitcoin usage can be tracked. Since the network is transparent, the progress of a particular transaction is visible to all.

This makes bitcoin not an ideal currency for criminals, terrorists or money-launderers.

4 - Immutability

Bitcoin transactions cannot be reversed, unlike electronic fiat transactions.

This is because there is no central "adjudicator" that can say "ok, return the money." If a transaction is recorded on the network, and if more than an hour has passed, it is impossible to modify.

While this may disquiet some, it does mean that any transaction on the bitcoin network cannot be tampered with.

5 - Divisibility

The smallest unit of a bitcoin is called a satoshi. It is one hundred millionth of a bitcoin (0.00000001) – at today's prices, about one hundredth of a cent. This could conceivably enable microtransactions that traditional electronic money cannot.

Cryptocurrency Has Already Made You Rich – You Just Didn’t Notice

When your altbags are weighing heavy and you haven’t checked your portfolio in days. When your long has been liquidated and that ICO has taken your ether and fallen silent. When regulators are cranking up the rhetoric and FUD is the only acronym in town. When all of these things conspire against you, it’s easy to get downhearted and forget about the many ways in which crypto has already made you rich.

Also read: The Current Crypto-Bear Run Will be Nothing Like 2014

Consider the Following

Cryptocurrency Has Already Made You Rich – You Just Didn’t NoticeCrypto can be a cruel mistress, giving with one hand and taking away with the other. One moment she’s rushing you to the top of the roller-coaster with your heart in your mouth and your Blockfolio in your hand. The next, she’s plunging you into the deepest of dips, drowning your gains and obliterating all hope.

At those low points, it’s easy to feel despondent. You were promised the moon and left in the gutter, with the jeers of your co-workers and spouse still ringing in your ears. You HODL’d when you were supposed to, bought the dip, and had the sense to avoid Bitconnect. You even read the white paper of that ICO you bought into – all 51 pages of it – and what have you got to show for it? Zip. Nada. Diddly squat. Perhaps you were just destined to stay poor. Or perhaps you just misunderstood what it means to be crypto rich.

Crypto High Is the World’s Toughest School

Who taught you to 2FA everything after years of sloppy op-sec?

Crypto did that.

Who gave you a fundamental understanding of Austrian School economics and the ability to spot an inverted H&S at 100 paces?

Crypto did that.

Who taught you to value your privacy long before Facebook began leaking it, and who helped you swap your World of Warcraft addiction for an unquenchable craving for knowledge?

Who instilled a passion to learn that you haven’t experienced since you were in kindergarten? Who taught you that the only person in this life you can rely on is yourself, and that only through taking control of your data, your education, and your vocation can you control your destiny?

Oh yeah, crypto did all that.

You see that graph below? That’s not bitcoin. That’s your brain on bitcoin.

Cryptocurrency Has Already Made You Rich – You Just Didn’t Notice

Come for the 100x Gains, Stay for the Esoteric Knowledge

Think back to when you first discovered crypto, be it last year, 2013, or way back at the beginning. Now think of the pre-crypto you and the version that exists today. Odds are they feel like two different people. If the cryptoverse has captivated you, like it does to so many who drift into its realm, the you of today is likely to be smarter and more inclined to question everything. An autodidact intent on grabbing life by the cojones rather than letting it slip through their fingers.

Cryptocurrency Has Already Made You Rich – You Just Didn’t NoticeSure, there are bound to be trade-offs along the way. Perhaps you’ve turned into that guy who always brings up bitcoin at parties. Or that girl who now has “crypto trader” in all her social bios. You might find you’ve less in common with your former friends, and after a couple of tequilas are prone to embarking on rants about the turpitude of Asicboost and why Bram Cohen is probably Satoshi. Bitcoin isn’t guaranteed to make you a better person. But it’s almost certain to have made you a wiser and more self-deterministic one. As the saying goes, give a man crypto and you feed him for a day. Teach a man crypto and you feed him for life.

Not All Riches Can Be Measured in Zeroes

The truth is, you could walk away from all of this tomorrow and crypto would have set you up for life. Not financially necessarily, but in every other respect you’re better equipped than you’ve ever been for anything the world may throw at you. And there’s not a 51% attack or exchange hack in the world that can change that. Quantum computers could pop every private key and burn this whole damn cryptocurrency revolution to the ground and you’d emerge digitally poorer but inestimably richer.

It turns out that bitcoin’s killer feature isn’t blockchain or decentralization – it’s knowledge. Sure, brains alone won’t pay the bills, but the skills you’ve acquired since entering this space, and will continue to acquire for every day you remain, will benefit you more than any 10x altcoin ever could.

Cryptocurrency has already made you rich. You just didn’t notice.

Has discovering cryptocurrency given you a newfound thirst for knowledge? Let us know in the comments section below.

Images courtesy of Shutterstock and Coincodex.

This is an Op-ed article. The opinions expressed in this article are the author’s own. Bitcoin.com does not endorse nor support views, opinions or conclusions drawn in this post. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the Op-ed article. Readers should do their own due diligence before taking any actions related to the content. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any information in this Op-ed article.

Maltese Parliament Passes Laws That Set Regulatory Framework For Blockchain, Cryptocurrency And DLT

July 4, 2018 marks a historical day for Malta, as the Maltese Parliament has officially passed 3 bills into law, establishing the first regulatory framework for blockchain, cryptocurrency and DLT (Distributed Ledger Technology). This makes Malta the first country in the world to provide an official set of regulations for operators in the blockchain, cryptocurrency and DLT space.

“I think that blockchain technology, DLT and cryptocurrency is where innovation is happening right now and we are very glad that Malta can offer the first jurisdiction in the world to regulate this sector. We are excited about what this will lead to in the future,” Joseph Muscat, Malta’s Prime Minister, told me.

Just last week, the Maltese Parliament voted unanimously to approve 3 cryptocurrency and blockchain bills, which were designed to make Malta one of the most desirable locations to set up shop in the blockchain space. As these bills have now been passed into laws, Malta is sure to become an early pioneer in economic innovation. In turn, this will strengthen the country’s economy with the creation of a new economic niche.

Moreover, Malta’s Junior Minister for Financial Services, Digital Economy and Innovation, Silvio Schembri, noted that the passing of the new laws mark an important milestone in which companies will be provided with the necessary tools to operate in a regulated environment.

When we started looking into what was needed for the blockchain industry to flourish, we understood early on that the serious operators wanted legal certainty. As of now, operators are functioning in jurisdictions of legal uncertainty. Operators fear that one day a government in that particular legislation will tell them they aren’t within the law - even though there are currently very few laws in place. This is creating legal uncertainty and we wanted to change this, Schembri told me.

What Are Ethereum Tokens? (ERC-20, ERC-223, ERC-721, And ERC-777 Tokens Explained)

As if understanding Bitcoin wasn’t difficult enough, Ethereum adds a whole new level of complexity to the equation. Even if you have a solid technical background, it’s going to take some time and independent research before everything makes sense – unless you’re a genius, anyway.

With that being said, a basic understand of how Ethereum works can actually make it simpler to understand cryptocurrencies in general. You see, Ethereum is a decentralized platform upon which smart contracts can be written (in the Solidity programming language) and executed. It is the base layer that supports hundreds of decentralized applications (dApps).

Whenever a new application for blockchain technology and smart contracts is developed on top of Ethereum, a new Ethereum token can be created. The simplifying aspect of this process is that Ethereum has set standards for tokenization. Different types of applications will be tokenized according to different standards, depending on what the application is meant to do.

As a result of these standards, it is much more straightforward for smart contracts and tokens to interact and, therefore, for developers to create dapps on Ethereum. The common analogy you’ll hear to explain this benefit is that Ethereum is like the iOS or Android for dapps – an operating system that supports the applications and makes them much easier to build.

The most common standard for Ethereum tokens is currently the ERC-20 standard, but there are also ERC-223, ERC-721, and ERC-777 standards. In this article, we will explain each standard and how it is being used in the decentralized ecosystem.

What is an ERC-20 Token?

The ERC-20 standard used in smart contracts contains just 6 basic functions that make the token, well… functional. The code is so simple that you don’t need to have any computer science knowledge to understand it. Let’s go through it piece by piece.

First there is the totalSupply() function, which determines the total amount of tokens that will be created to be exchanged within a given project’s token economy.

Then there is the transfer() function, which is used for the initial distribution of tokens to user wallets. This function is the biggest reason that ERC-20 tokens have become so popular for ICOs, as it makes it incredibly easy to send tokens to investors when the ICO has been completed.

The transferFrom() function is what then enables token holders to exchange tokens with one another after the initial distribution. Supposing that you want to send some BAT to a friend, this function takes your Ethereum wallet address, the recipient’s Ethereum wallet address, and the amount being sent, and then executes the transaction.

Next, as implied by its name, the balanceOf() function keeps track of the token balance in each user wallet. Simple enough.

The approve() function, meanwhile, is used to guarantee that the total token supply within the economy is held constant. In other words, this function is in place to ensure that nobody can create additional tokens out of thin air to benefit themselves.

Finally, the allowance() function makes sure transactions are valid before they are added to the blockchain. Whenever a user wants to transfer some tokens to another wallet, this function checks that the sending address has at least as many tokens as the amount stipulated in the transferFrom() function. In the event that it doesn’t, the transaction is not valid.

With these 6 functions, creating new tokens and developing platforms and wallets for them is exceedingly straightforward. This standard has already been employed by thousands of different projects. In fact, all of the projects in the Top 20 Ethereum Tokens are ERC-20 tokens.

TL;DR

ERC-20 Tokens:

Are the current industry standard

Consist of 6 key token functions

Already used by thousands of different cryptocurrency projects

What is an ERC-223 Token?

While the ERC-20 standard is very useful, it’s far from perfect. For example, one particularly bad design flaw with ERC-20s made it possible for tokens to be lost when people mistakenly send them to a smart contract using the process they would use for sending tokens to an ordinary wallet. Unfortunately, this has already resulted in the loss of over $3 million worth of ERC-20 tokens to date.

ERC-223 addresses this design flaw by allowing users to transfer tokens to smart contracts and wallets with the same function. Additionally, ERC-223 tokens improve on the efficiency of ERC-20s by making transfers require only 1 step rather than 2. That means that ERC-223 token transfers require only half the Gas (i.e. cheaper) as compared to ERC-20 transfers.

And on top of that, ERC-223 tokens are backwards compatible with ERC-20 tokens, meaning that they maintain all the original functionality while solving those bugs mentioned above.

As a result of these advantages, the ERC-223 standard may someday supplant ERC-20 as the most widely used standard for Ethereum tokens. However, most Ethereum wallets don’t yet support ERC-223 tokens, so adoption by project developers has been slow.

Given how quickly the cryptocurrency ecosystem evolves, though, don’t be surprised if ERC-223 tokens take off in popularity in 2019 or even sooner.

TL;DR

ERC-223 Tokens:

Address key flaws with the ERC-20 token standard

Require only half the Gas of ERC-20 tokens

Are backwards compatible with ERC-20

Have not yet been used by any noteworthy cryptocurrency projects

What is an ERC-721 Token?

ERC-721 tokens earned their first claim to fame when the Ethereum-based collectibles game, CryptoKitties, gained popularity at the end of 2017.

The key difference between the ERC-721 token standard and other ERC standards is that ERC-721 enables developers to easily create non-fungible tokens (NFTs). In other words, one token can be worth a different value than another token that’s being exchanged within the same platform/ecosystem.

Non-fungible tokens are extremely useful because they enable the tokenization of unique individual assets. That includes carefully bred digital cats, but also much more conventionally valuable assets such as artwork, vintage wines, real estate, diplomas, and more.

One of the best projects in the Ethereum ecosystem, 0x protocol, is working to add support for ERC-721 tokens and other new token standards in its v2 release, scheduled for late July 2018.

Another high-quality but new and lesser known project, 0xcert, focuses specifically on non-fungible tokens and enables anybody to create, own, and validate unique assets on the blockchain. Moreover, 0xcert makes it easy for developers to create dapps and smart contracts tailored to various types of unique assets.

As more real-world assets are tokenized in the coming years, you can bet that the ERC-721 token standard will become known for a lot more than CryptoKitties. Ownership of anything from fine art and music royalties to tickets for the next day’s ballgame can all be transparently transferred on the Ethereum blockchain. Supply chains can ensure product integrity and traceability at an unprecedented level. The possibilities for ERC-721 are exciting to say the least.

TL;DR

ERC-721 Tokens:

Are non-fungible tokens (NFTs)

Can be used to tokenize unique individual assets

First used by the Ethereum dapp CryptoKitties, but have many possible applications beyond digital gaming

What are ERC-777 and ERC-820 Tokens?

Similarly to ERC-223, ERC-777 is intended to improve upon the ERC-20 token standard and is backwards compatible with it.

One way ERC-777 is better than ERC-20 is that, like ERC-223, it addresses the design flaw that has led to over $3 million in lost tokens. What makes the ERC-777 standard unique, though, is the breadth of transaction handling mechanisms it includes.

To explain ERC-777, we must first start with the ERC-820 token standard. In that standard, a central registry of smart contracts is established on the Ethereum network. The registry makes it possible for anybody to “examine” a smart contract address and check the functions that it supports.

ERC-777 uses the same ERC-820 central registry to make smart contract functions easy to verify. It also establishes an entirely new set of functions rather than using the same ‘transfer’ and ‘approve’ functions employed in the ERC-20 standard. In place of those, ERC-777 uses a ‘send’ function which is used to transfer Ether itself.

Another big selling point for ERC-777 is that it allows for ‘approved operators’, meaning that people can approve smart contracts to move tokens on their behalf. This makes ERC-777 highly customizable, as it allows people to build extra functionality on top of tokens such as a mixer contract for improved transaction privacy or an emergency recover function to bail you out if you lose your private keys.

Additionally, ERC-777 creates a standard for minting and burning tokens, something which can be very useful depending on a project’s specific token economics.

Unfortunately, however, there are not yet any well-known applications built on the ERC-777 token standard for us to reference, so it remains to be seen whether this standard will be widely adopted in the future. Considering that it is more customizable than ERC-20 and reduces friction on transactions, just about every application on ERC-20 today could benefit from a move to ERC-777 in the future.

For anybody who really wants to dig into the details, further explanation of the transaction handling mechanisms that are part of the ERC-777 standard can be found in its github repository.

TL;DR

ERC-777 Tokens:

Address key flaws with the ERC-20 token standard

Are backwards compatible with ERC-20

Use functions used to transfer ETH itself, making transactions smoother

Allows for “approved operators,” making it more customizable than previous standards

Looking Ahead

The Ethereum platform isn’t staying static and neither are the token standards for building on top of it. While ERC-20 tokens dominate the Ethereum-based portion of the market for now, the future should see more and more projects moving to the new and improved ERC-223 or ERC-777 token standards.

With over 100,000 Token Contracts already live on Ethereum (yes, you read that right), the pace of development is showing no signs of slowing down. Most of those tokens will no doubt be redundant, useless, and valueless, but a select few of them might just change the world as we know it.

Latest Posts

-

The Cryptocurrency Foryoucoin

08-05-2019 22:10 -

FYC back on the rise

08-02-2019 15:05 -

Great Valuations

Great Valuations from Foryoucoin!

05-27-2019 18:18 -

Great valuations

Great valuations!

05-06-2019 20:38 -

Market orders are available

We inform you a new mode of action for buying and selling crypto currencies is available at Thex Trade.

02-01-2019 19:42 -

What is Bitcoin?

To cut through some of the confusion surrounding bitcoin, we need to separate it into two components. Read More

10-04-2018 22:01 -

Cryptocurrency Has Already Made You Rich – You Just Didn’t Notice

Cryptocurrency Has Already Made You Rich – You Just Didn’t Notice

10-04-2018 21:59 -

Maltese Parliament Passes Laws That Set Regulatory Framework For Blockchain, Cryptocurrency And DLT

Maltese Parliament Passes Laws That Set Regulatory Framework For Blockchain, Cryptocurrency

10-04-2018 21:42 -

What Are Ethereum Tokens? (ERC-20, ERC-223, ERC-721, And ERC-777 Tokens Explained)

As if understanding Bitcoin wasn’t difficult enough, Ethereum adds a whole new level of complexity to the equation

10-04-2018 21:38